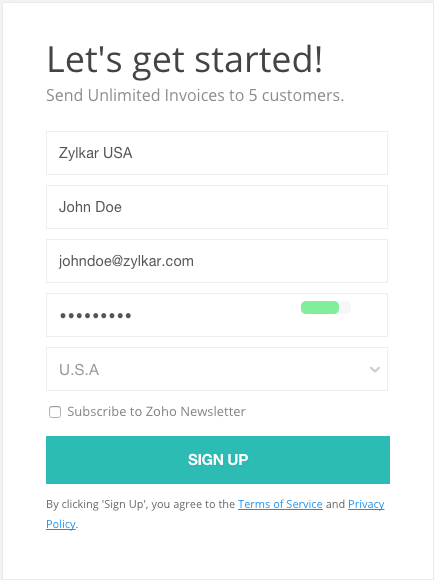

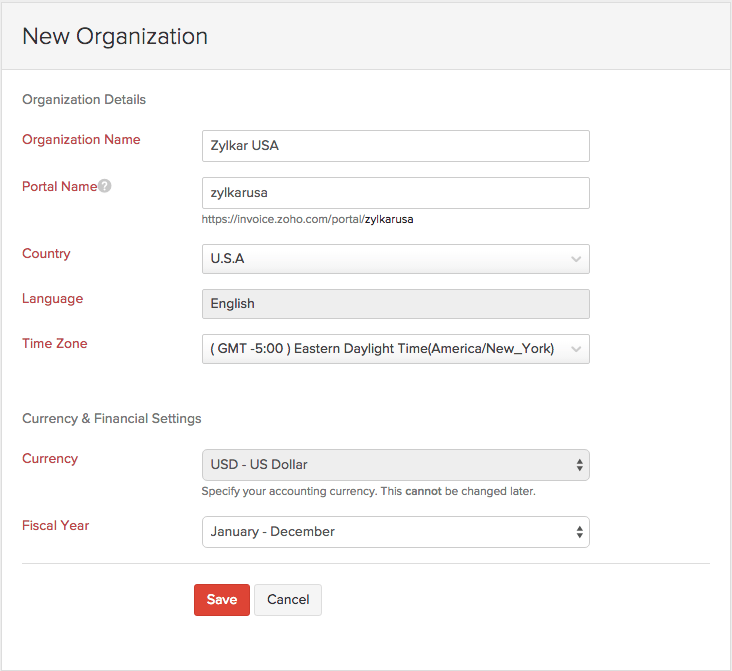

The Sales Tax feature is exclusive to the USA. You need to create a new organization and select your country as US to make use of this feature. Below are a list of operations you can perform with sales tax.

In Zoho Invoice, your business is termed an organization. Find out how you can create a new organization for your business.

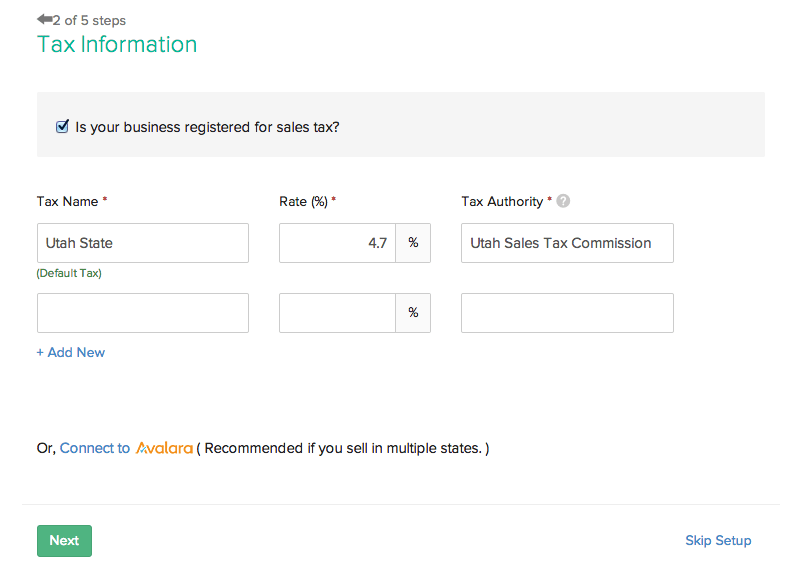

If you are using Zoho Invoice for the first time, click Quick Setup in the Getting Started page. Choose Taxes. Enter tax details and save.

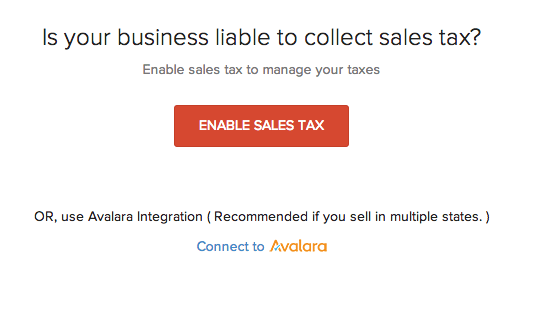

This section takes you through the process of enabling sales tax in Zoho Invoice. Here’s what you should do.

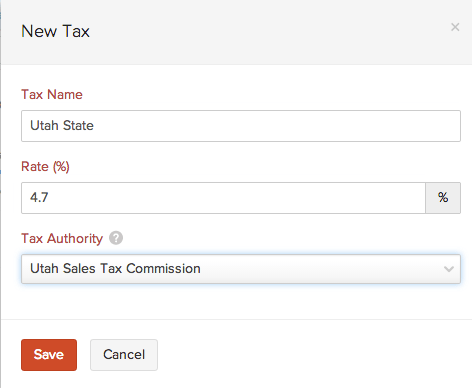

Before using sales tax in your invoices and estimates, you need to create a new tax. For example, the State sales tax rate of Utah is 4.7%.

Insight: Tax Authority can be created here in the New Tax form and by choosing New Tax Authority from the + New Tax drop down as well.

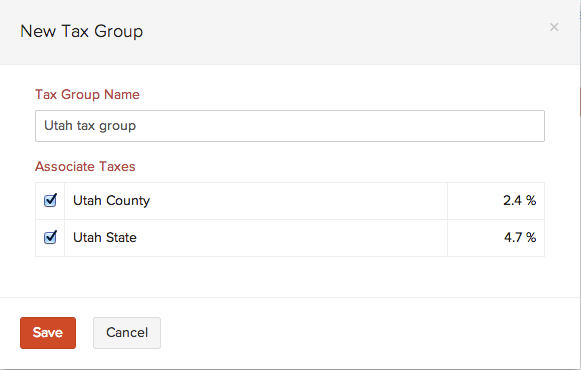

There might be occasions when multiple taxes need to be applied. You can club the individual taxes under a group. For example, Utah’s State sales tax rate is 4.7%, local sales tax rate is 1% and the County Option Sales Tax rate is .25%.

You’ll find that the tax group is a single entity with the percentage rate of individual sales taxes in the group summed up. This makes it easier to use tax groups in transactions.

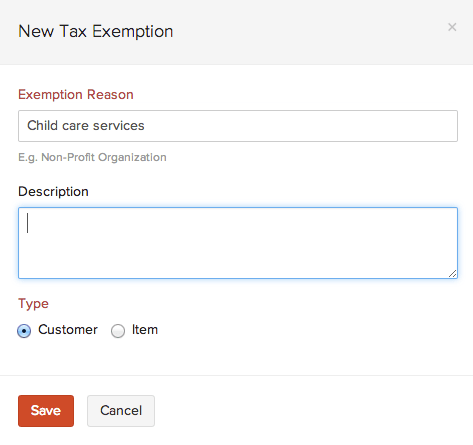

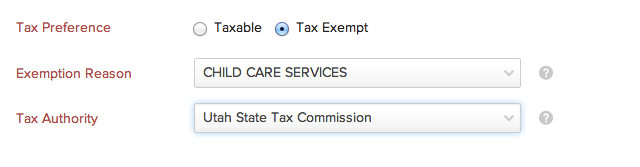

You can create new tax exemptions for customers and items. E.g. Child care and non-profit organizations are exempt from taxes.

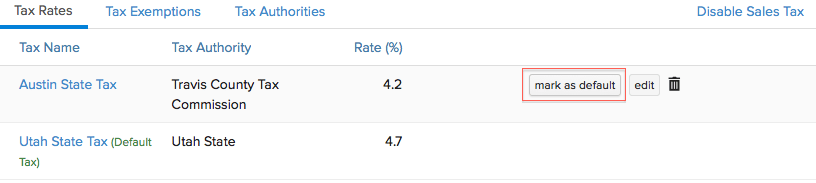

The Default Tax will be used in transactions when tax preference (Taxable/Tax Exempt) is not set for the involved customers. The first tax you create will be marked as the Default Tax initially. However, you can mark a different sales tax as default as well.

Default Tax can be useful for the following scenarios.

Insight: Default Tax is not automatically associated with a customer. It is only used when tax preference (Taxable/Tax Exempt) is not set for the involved customers. You can set the Tax Preference of a customer at anytime.

To mark a different tax as default, click the gear icon on the top right corner and select Taxes. Now choose the tax to be marked as default and click “Mark as Default”.

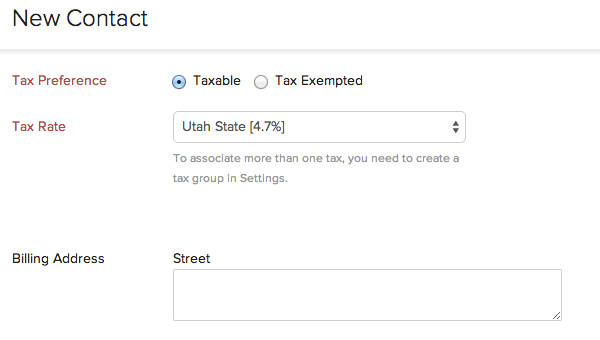

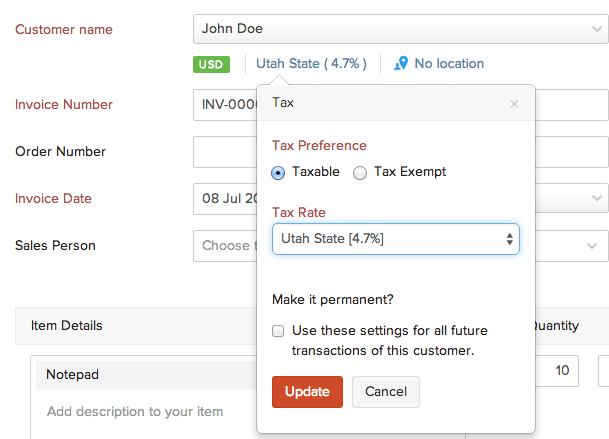

Let’s say, your customer resides in Utah where a sales tax rate of 4.7% applies. Read below to find out how you can associate this rate to the customer.

There might be occasions where your customer is a non-profit organization which is exempt from tax. You can make a particular customer non-taxable by following the below steps.

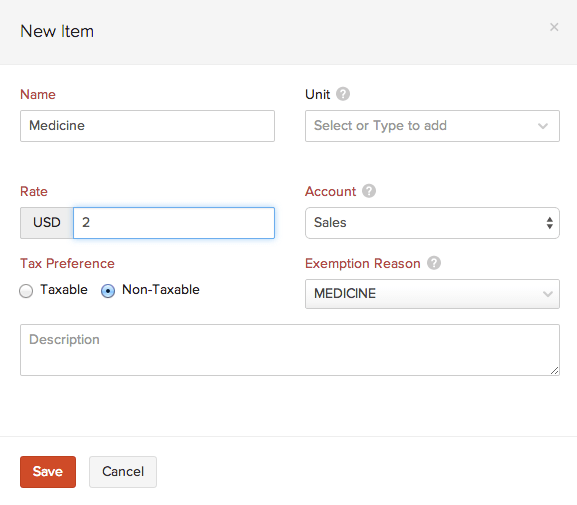

You can also choose tax preferences for items.

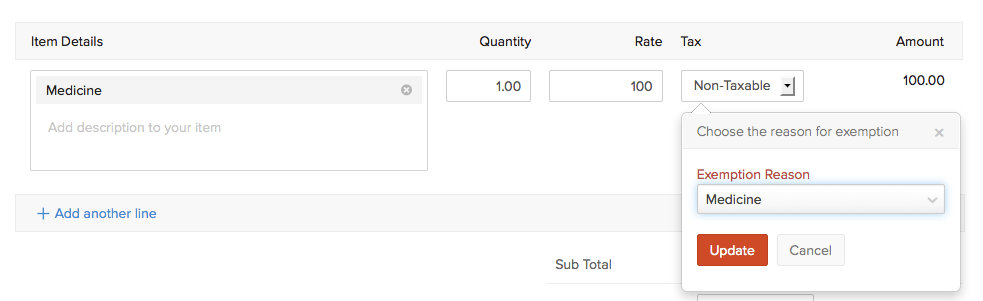

You can make a particular item non-taxable in an invoice.

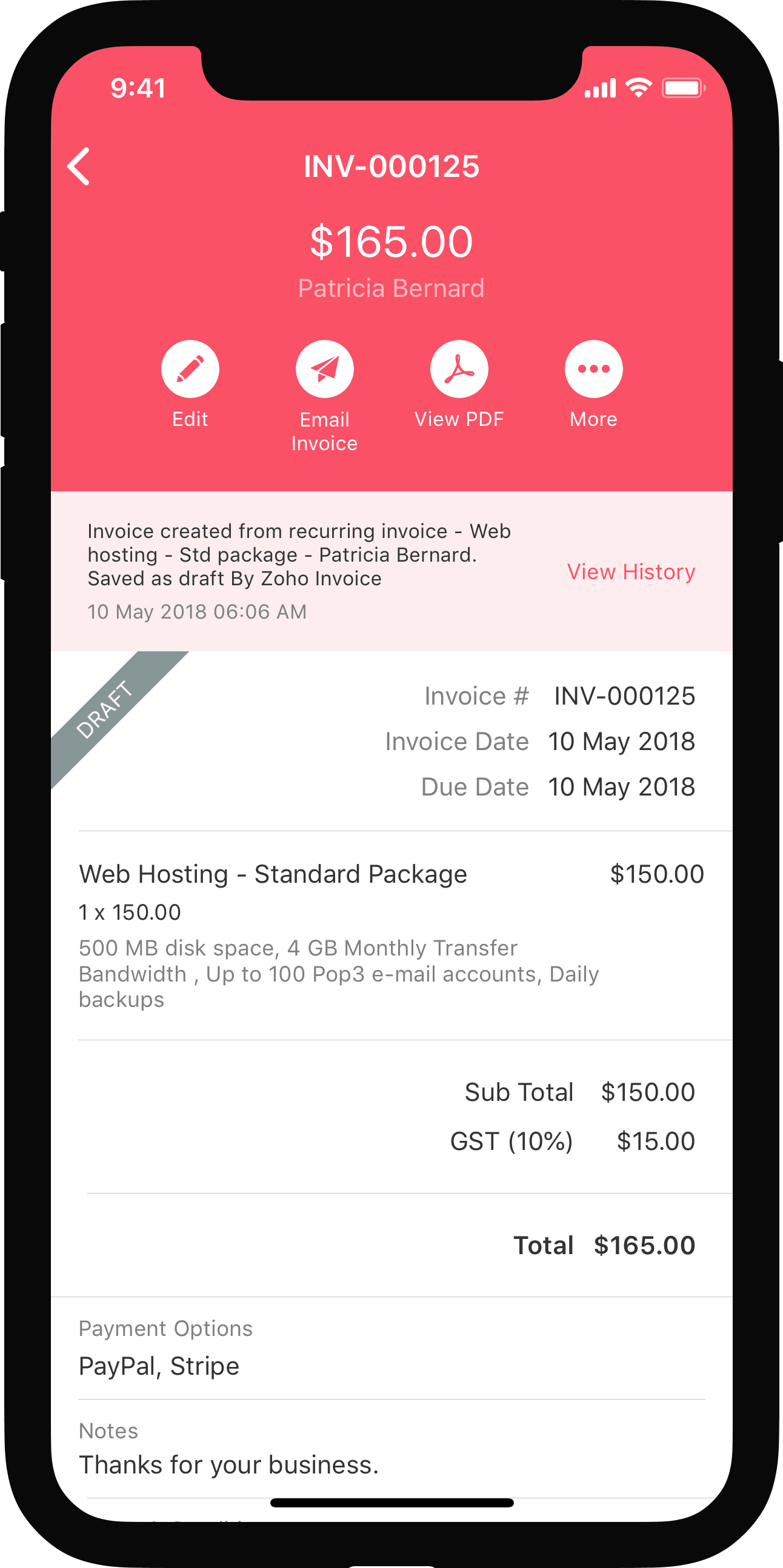

After associating specified sales tax for contacts, the next step is applying sales taxes to invoices. If you choose a customer whom you have already associated tax with, then the corresponding tax will be applicable to all taxable items. However, if you choose to make the transaction non-taxable, you’ll be asked to enter a suitable exemption reason.

The same steps can be followed while applying sales tax to recurring invoices as well.

Insight: Recurring invoices will not be created unless sales tax is applied. This can happen when you have created a recurring invoice before enabling sales tax. After enabling sales tax, you can apply a tax rate to the recurring invoice using the above steps.

You can make a particular transaction nontaxable even if you have associated tax with the customer involved in the transaction. Tax will be disabled for that transaction and you’ll not be able to apply tax to individual items as well.

Insight: All sales tax related operations that can be performed with invoices are applicable to estimates, credit notes, sales orders and recurring invoices as well.

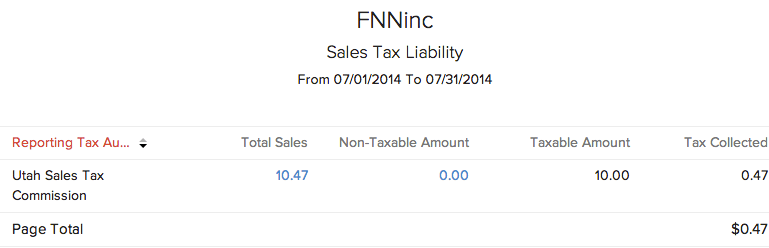

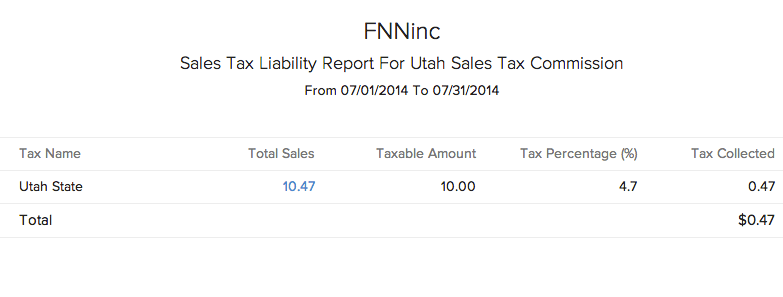

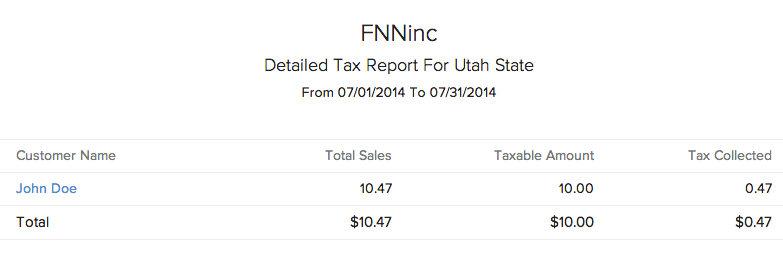

You can view detailed tax reports which displays clearly the taxable and non-taxable amount for a Tax Authority.

| Name | Description |

|---|---|

| Tax Name | It simply refers to the name you’d like to assign to a particular tax. For example, Austin can be the name assigned to the sales tax for the city of Austin. |

| Tax Authority | It refers to the organization in charge of collecting taxes in a specified region. For example, the Travis County Tax Office is the tax authority for Austin, Texas. |

| Rate | It refers to the tax rate for a particular region in percentage. For example, the tax rate in Austin, Texas is 8.25 (percentage). |

| Exemption Reason | Users have to enter why a customer/transaction/item is exempt from sales tax. For example, Child Care and Non Profit Organizations are exempt from tax. |

Available in all mobile platforms