Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home › Shopping for Auto Insurance › Best Auto Insurance Companies › 9 Best Auto Insurance Companies That Don’t Use Credit Scores (2024)

D. Gilson, PhD

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S.

Written by D. Gilson, PhDProfessor & Published Author

Brandon Frady

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi.

Reviewed by Brandon FradyLicensed Insurance Producer

UPDATED: Mar 4, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 4, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

19,116 reviews

19,116 reviews

Compare Rates → Best Savings No Credit Check: Nationwide

3,019 reviews

3,019 reviews

Compare Rates → Best Pay-Per-Mile No Credit Check: Allstate

11,413 reviews

11,413 reviews

Compare Rates →Geico and Nationwide are the best auto insurance companies that don’t use credit scores with usage-based insurance. Sign up for Geico DriveEasy or Nationwide SmartRide for cheap no-credit-check car insurance.

While many national providers check credit with standard policies, drivers with bad credit can sign up for pay-per-mile or usage-based auto insurance (UBI) from the best auto insurance companies that don’t use credit scores to avoid traditional credit checks.

Our Top 9 Picks: Best Auto Insurance Companies That Don’t Use Credit Scores| Company | Rank | Credit Check | Available In | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | Yes | 50 states | Low Rates | Geico | |

| #2 | Yes | 44 states | Usage-Based Rates | Nationwide | |

| #3 | Yes | 50 states | Pay-Per-Mile Rates | Allstate | |

| #4 | No | 34 states | Good Drivers | Root | |

| #5 | Yes | 50 states | Military Drivers | USAA | |

| #6 | No | 11 states | No Tracking Devices | MileAuto | |

| #7 | No | 8 states | Tech-Savvy Drivers | Metromile | |

| #8 | No | 1 state | Texas Drivers | Dillo | |

| #9 | No | 3 states | New Jersey Drivers | CURE |

You might be surprised to learn how credit scores affect auto insurance rates. Keep reading to learn more about which auto insurance companies don’t check credit and the states where companies cannot use credit scores when setting your premiums. You can also enter your ZIP code above to compare quotes.

Things to Remember

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

There are various factors that affect your auto insurance rates, and you might be surprised to learn that your credit score can also have an impact. Take a look at this table that shows you just how much your credit score can affect your auto insurance rates:

Auto Insurance Companies That Don't Use Credit Scores Monthly Rates| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Root | $43 | $58 | $74 |

| Geico | $80 | $109 | $138 |

| Nationwide | $115 | $156 | $197 |

| Allstate | $160 | $220 | $275 |

| USAA | $59 | $80 | $101 |

| Mileauto | $60 | $80 | $105 |

| Metromile | $115 | $157 | $198 |

| Dillo | $90 | $120 | $155 |

| Cure | $111 | $151 | $191 |

Root and Metromile offer the lowest average rates to drivers with bad credit. Both companies do not check credit score — Root sets rates based on your driving habits and location while Metromile exclusively tracks mileage to set rates. Geico and USAA both check credit but still offer affordable auto insurance rates for drivers with bad credit scores.

Unfortunately, finding companies that do not use credit scores is next to impossible unless you look at pay-as-you-go-auto insurance companies or usage-based insurance (UBI) programs.

Do auto insurance companies check your credit rating? Yes, most auto insurance companies that do use credit scores believe that drivers who have good credit will be more willing to pay out of pocket for damages and are less likely to file a claim.

Drivers with bad credit are more likely to pay higher rates because companies assume they are more likely to file a claim.

Eric Stauffer Licensed Insurance Agent

Do car insurance companies check your credit in all states? No, California, Hawaii, Massachusetts, and Michigan don’t allow auto insurance companies to use your credit score to determine your rates. Read our state insurance guides to learn more about no-credit-check auto insurance near you.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

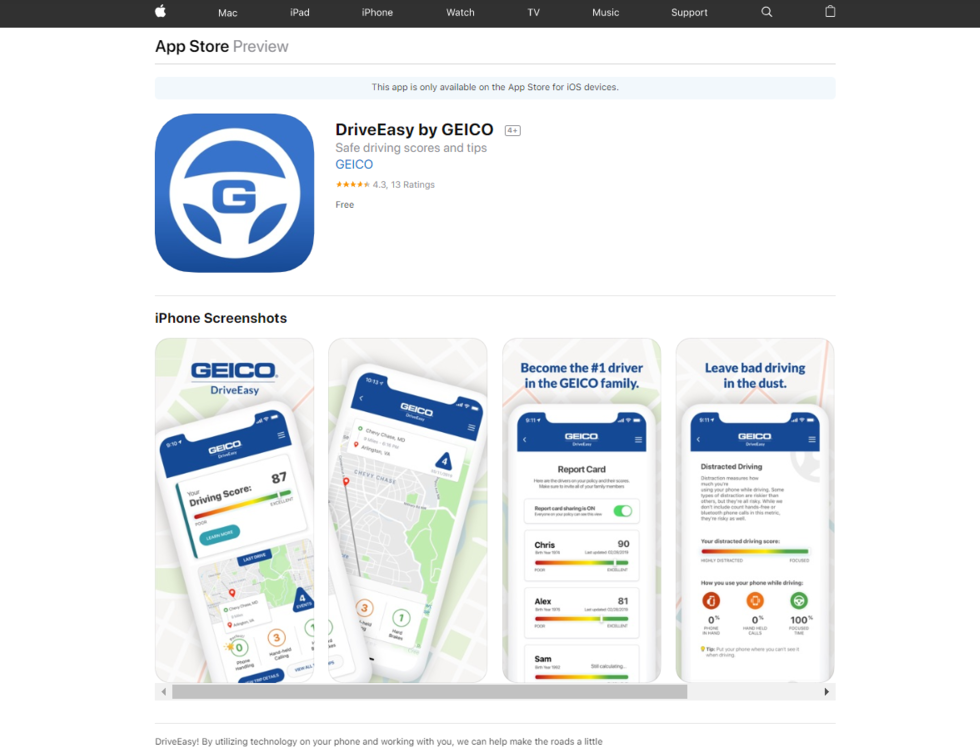

Even if you can’t find car insurance with no credit check, there are other ways you can save on your auto insurance. Signing up for usage-based or pay-per-mile insurance can help you get cheap no-credit-check auto insurance rates. Learn how to sign up in our Geico DriveEasy review.

insurance companies that don" width="980" height="748" />

insurance companies that don" width="980" height="748" />

Take advantage of any available auto insurance discounts. Most auto insurance companies offer a lot of discounts in different areas. For example, you can get a good student discount, a good driver discount, or even discounts based on the safety features of your car.

You can also work to raise your credit score. Make your auto insurance payments on time and be mindful of the credit accounts you have. Raising your credit score will help lower mortgage or auto loan rates as well as car insurance rates.

While knowing what car insurance company doesn’t check credit can be very difficult, not all auto insurance companies charge high rates for bad credit. Shop around and compare quotes from auto insurance companies that use credit scores and ones that don’t — you might find that a standard company offers you lower rates.

Geico, Nationwide, and Allstate are all standard companies that use traditional rating factors but still offer low rates to drivers with bad credit. Each company also offers UBI and pay-as-you-go policies that don’t require a credit check.

The good news is getting auto insurance quotes will not hurt your credit score. So, enter your ZIP code below to compare as many online insurance quotes as you can before you buy to ensure you’re getting the best rates.

California, Hawaii, Massachusetts, and Michigan are the only states where it is illegal for insurers to use credit scores when setting rates.

Root, Mileauto, and Metromile are three car insurance companies that do not check credit scores. You will also find affordable auto insurance with bad credit with Geico, Nationwide, and Allstate UBI programs.

Yes, State Farm generally checks your credit score when evaluating your auto insurance rates.

In states allowing it, Progressive checks credit history as it periodically reviews policies.

Yes, Geico will check your credit history but still offers low rates to drivers with bad credit.

Yes, Allstate will check your credit score to set rates unless you sign up for Allstate Milewise pay-as-you-go insurance.

Root offers the lowest rates to qualifying drivers with bad credit at $74/mo.

Opting for an auto insurance company that doesn’t check credit can be beneficial if you have a less-than-perfect credit history. It allows you to obtain coverage without worrying about your credit score impacting your premiums or coverage options.

No, there isn’t a hard credit check when you evaluate auto insurance quotes.

The best way to determine if a particular auto insurance company checks credit is to reach out to them directly. Contact their customer service or visit their official website to inquire about their underwriting process and whether credit checks are part of it.

Generally, auto insurance companies require your consent to check your credit. They must comply with privacy and data protection regulations, which typically require explicit consent from the policyholder before accessing their credit information. However, it’s essential to review the terms and conditions of the insurance company to understand their specific practices regarding credit checks.

The legality of denying coverage based on credit scores can vary by jurisdiction. In some states or countries, it may be prohibited to use credit scores as the sole basis for denying coverage. However, in other regions, insurance companies may have the discretion to consider credit scores as a factor in determining coverage eligibility. It’s advisable to consult local laws and regulations or seek legal advice to understand the specific rules in your area.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption